A Review of the Global Composites Market and Turkish Composites Market

The Global Composites Market

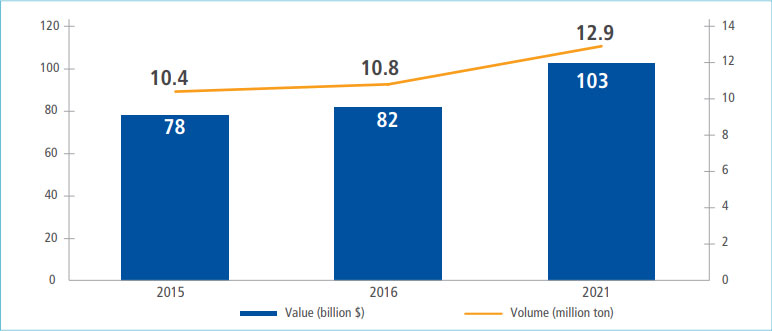

In 2016, the volume of the global composites market reached 10.8 million tons. The market volume, which was 10.4 million tons in 2015, is expected to reach 12.9 million tons by 2021. The average year-on-year volume growth rate throughout the period between 2016 and 2021 is expected to be roughly 4 percent. In 2016, the value of the global composites market hit $82 billion. The value of the market, which amounted to $78 billion in 2015, is expected to reach $103 billion by 2021. The average year-on-year value growth rate throughout the period between 2016 and 2021 is expected to be roughly 5 percent.

Figure 1. The global composites market in terms of value and volume

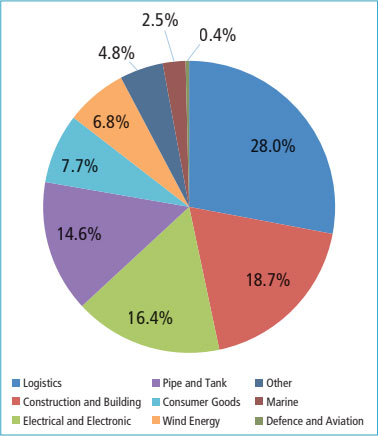

Figure 2. Distribution of the global composites market by application in terms of volume in 2016

Figure 2. Distribution of the global composites market by application in terms of volume in 2016

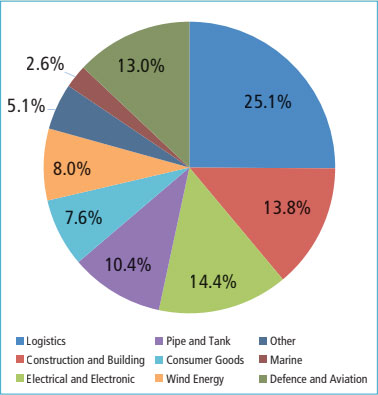

A review of the applications of the composites industry within the global composites market reveals that the top four industries in terms of volume are transportation, construction and building, electrical and electronic goods and the pipe and tank manufacturing industries. In terms of value, the top four industries which employ composite products are transportation, construction and building, electrical and electronic goods and the defense and aviation industries. The most remarkable industry among these is the defense and aviation industry. The defense and aviation industry, which ranks in final position in terms of volume, with only 0.4 percent by mass, is among the top three industries in terms of value, representing 13 percent of the market, indicating the high value-added nature of the composite products employed within the industry.

Figure 3. Distribution of the global composites market by application in terms of value in 2016

Figure 3. Distribution of the global composites market by application in terms of value in 2016

The development of the composites industry will vary depending on the relevant fields of application. While the growth rate in the maritime, construction and building and consumer goods industries is expected to see a growth rate of 0 to 2 percent; the growth rate in electrical and electronic goods, pipe and tank manufacturing, transportation and aerospace and aviation industries is estimated to be from 3 to 7 percent. The sale of composites to the wind power industry is expected to grow by 15 to 20 percent on a year-on-year basis with an optimistic perspective.

It is noted from a review of unit prices in 2016 that the composite materials used in the defense and aviation industries have a high added value

Table 1. Unit value per kilogram of composite materials by the industry, where composite material is used ($)

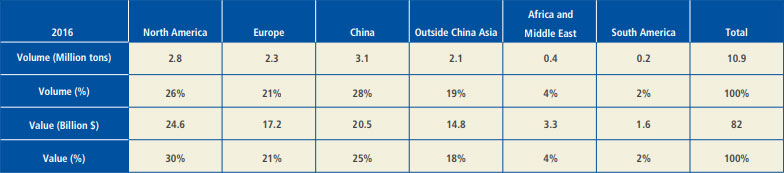

In 2016, the Asian market, with 5.2 million tons, held the largest market share, accounting for 47 percent of the global market in terms of volume and 43 percent in terms of value. The Chinese market alone accounts for 28 percent of the global market, or 3.1 million tons. The North American market, with 2.8 million tons, accounted for 26 percent of the global market in terms of volume and 30 percent in terms of value. The European market accounts for 21 percent of the global market in terms of both volume and value. The African and Middle Eastern market, with 0.4 million tons, accounted for 4 percent of the global market in terms of both volume and value. Finally; the South American market accounted for 2 percent of the global market, at 0.2 million tons.

Table 2. Geographical distribution of the composites market in terms of volume and value in 2016

The global composites industry is predicted to grow by 4 percent on average on a year-on-year basis between 2016 and 2021. It is predicted that growth in China, which is expected to grow by 7 percent, will account for 60 percent of the said overall growth rate. Such a growth rate is larger than China's overall growth rate between 2010 and 2016, which was a combined total of 57 percent. The rest of the Asian market will grow by 3 percent on a year-over-year basis in the forthcoming period, contributing to the overall growth by 17 percent. It is predicted that the North American market will grow by 2 percent on a year-on-year basis, accounting for 11 percent of overall growth in the forthcoming period. The forecast for the growth rate on a year-on-year basis of the European market is 1 percent for the period between 2016 and 2021. Thus, the European market will maintain its share of 6 percent within overall growth. The share of the Asian market constantly grew between 2010 and 2016, as its market share, which was 45 percent in 2016, grew to 47 percent in 2015 and 2016. It is expected to attain 52 percent by 2021.

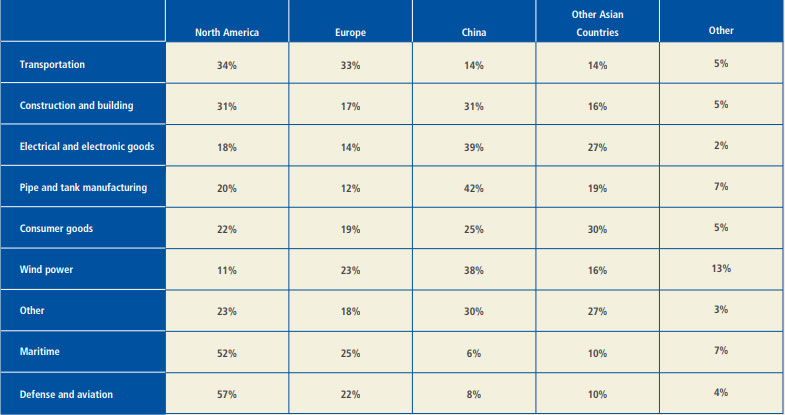

In Table 3, the distribution by industry of the composites market in terms of volume is examined. It is indicated that, in terms of volume, some 67 percent of the composite materials used in the transportation industry are used in North America and Europe, while 60 percent of the composite materials used in the construction and building industry were used in North America and China, and that North America holds a dominant share in terms of the use of composite materials in the maritime industry as well as the defense/aviation industry.

Table 3. Distribution of the composites market by application in terms of volume in 2016

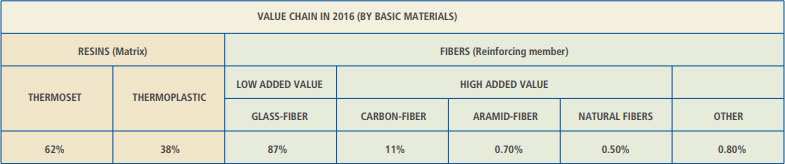

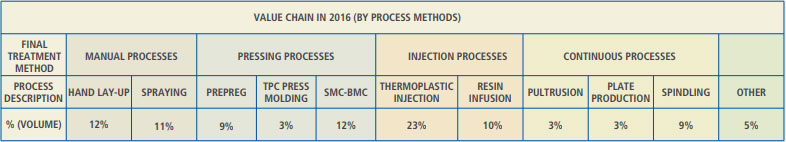

In 2016, the most commonly used composite materials in terms of volume worldwide were thermoset resins as matrix and glass-fiber, a low added value product, as a reinforcing agent (Table 4). Furthermore, the distribution of the processes employed to derive composite materials is provided within Table 5.

Table 4. Value chain by basic materials in the composite industry in 2017 (volume %)

Table 5. Value chain by process methods in the composite industry in 2017 (volume %)

Turkish Composites Market

The Turkish composites industry, which is comprised of some 700-800 companies at least partially engaged in the composites business, 180 of which are medium- and large-sized companies, employing roughly 8,200 people, produces products with a high added value.

Currently; the value of the Turkish composites market has reached €1.4 billion ($1.65 billion) and the volume of the same has reached 265,000 tons. The composites industry in Turkey is growing by way of gaining market share from replacement materials as it does in the rest of the world.

The composites industry is growing in Turkey at a higher rate than it is in Europe and elsewhere in the world. The Turkish composites industry has developed rapidly, and in the long term, as the case is with the other industries, it has developed in line with global economic developments, leveraging the effects of the dynamics within the country. The industry grew by 8 to 12 percent on a year-on-year basis in Turkey over recent years in line with then-prevailing economic conditions. The growth rate in 2016 has been 6 percent.

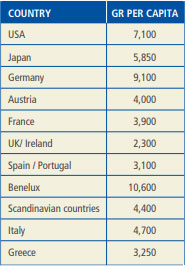

Table 6. Composites consumption amounts per capita in the world and in Turkey (gr)

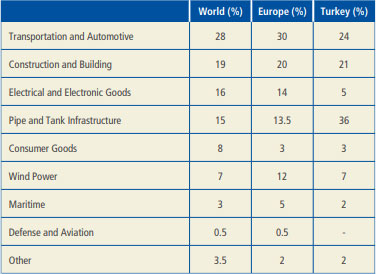

A review of composites consumption per capita, which is globally recognized as a "Development Criterion", reveals that Turkey is looking at considerable opportunities in respect of the composites industry. The said amount, which ranges between 4kg and 10kg across the world, is 3.4kg for Turkey. The average unit price, which is around €6.9/kg ($8.1/kg) globally, is roughly €5.3/kg ($6.2/kg) in Turkey. Both the consumption amount per capita and the average price in Turkey are considered advantages for the country in the forthcoming period. In terms of volume; composite products are most commonly used in pipe and tank infrastructure (36%), the transportation and automotive (24%) and construction and building (21%) industries in Turkey (Table 7). The acceleration of the production in Turkey of high-tech products is expected to increase the amount and the percentage of composite materials used, particularly wind power, aerospace and aviation as well as the electrical and electronic goods industries.

Table 7. Comparison of distribution by industry of composite materials in the world (%)

Also, the other composite applications with high growth potential include carbon fiber applications, pipe applications, automotive and transportation, greenhouse applications, solar panels, construction reinforcements, window and door applications, Polypropylene Random Co-polymer (PPRC) heating pipes (for boilers), engineering plastics and maritime applications.

There is a considerable distance Turkey must cover with respect to the production of machine-driven and high-tech products. Glass-reinforced plastic (GRP) pipe production, the growth rate of which has reached 36 percent, leveraging demand in Turkey and in surrounding countries, will continue being the driving force of the Turkish composites industry. Pultrusion, hot press molding (HPM) roll-up - hot press molding compound (BMC) and thermoplastic injection processes are expected to increase their market shares in the forthcoming period. Resin transfer molding (RTM) will continue its growth especially in wind power, maritime, automotive and transportation as well as the water slide industry.

Composite materials enjoy an advantageous position relative to the conventional materials of steel, aluminum and metal alloys for their high level of strength, light weight, design flexibility, capability of maintaining their form and functionality, electrical insulation, long service lives due to their being stainless and corrosion-resistant, the ability they offer to mold numerous parts which are monitored in conventional materials into a single piece instead of being designed in multiple pieces and subsequently assembled, as well as the ability to apply the desired color to the product during molding and to use the same for a long period of time without the need for maintenance, and the fact that the equipment chosen for production is cheaper irrespective of the selected molding method. Hence, over 50,000 successful applications that have so far emerged. The growth of the composites industry and the increase in the export levels of the same will enable Turkey, which produces a considerable portion of the relevant raw materials, to gain an advantage in global competition.

State-sanctioned market creation efforts such as the most recent wind power plant tender will accelerate the growth path of the industry, and will offer significant advantages to the companies that operate in the industry.

The composites industry falls into the scope of the chemistry industry on account of polyester, vinyl esters, epoxy and similar other resins being the main raw materials of thermoset products; into the scope of the plastics industry on account of polyamide (PA), polypropylene (PP), polycarbonate (PC) and other similar thermoplastics being the main raw materials of thermoplastic products; into the scope of the textiles industry on account of the technical textiles that are manufactured by way of the weaving and knitting of glass fibers, carbon fibers and aramid fibers; into the scope of the glass industry due to glass fiber production and certain other industries on account of the finished composite products that are employed in automotive, defense, aviation, construction, sports, entertainment, consumer goods and other similar industries.

The growth course of the composites industry is generally above that of global economic growth. This course will also remain unchanged in the forthcoming period.

The composites industry is a crucial industry for Turkey, since it produces high added-value products and composites are the materials of the future. It would be useful for governments, local governments, investors and industrialists to demand and prefer lighter composite material alternatives with longer service lives and higher strength, which offer more contemporary solutions, both for the benefit of such governments, local governments, investors and industrialists and for the benefit of the national economy. Currently, a decrease in the amount of energy and fossil fuel consumption in both the aviation and aerospace industries and the automotive industry is entirely and directly connected to the penetration into those industries of composite materials. It is estimated that this process will develop further, serving the interests of the composites industry, being an industry that offers inputs to and generates solutions for almost all other industries.

In that regard; it is considered that, as composite materials are used more effectively and prevalently in Turkey, composites production in Turkey will also be able to grow in high added-value industries; that, as the production of advanced composites becomes prevalent in Turkey, Turkey's export potential to not only Europe but also the entire world will increase, and the industry will contribute to covering Turkey's trade deficit.

Glass fiber (87%) and carbon fiber (11%), currently the most commonly-used reinforcement materials in the world, are both produced in Turkey. In respect of resins; while unsaturated polyester resin and vinyl ester resin are produced in Turkey, epoxy resins and thermoplastic resins are imported. Styrenes, phtalics, maleics and glycols, which are used for unsaturated polyester production, are not produced in adequate volumes in Turkey, so the need for the said items is covered entirely by way of imports. As the production of technical textiles, which are used for composite production, has grown in Turkey, the industry is now able to cover all its needs from the domestic market. The figures indicate that the composites industry currently exports some €250 million ($294 million) worth while it imports some €250 million worth.

The Turkish composites industry, which imports the chemical raw materials needed and exports the reinforcing materials and resins as well as technical textiles and finished products produced in Turkey, and which, therefore has helped balance foreign trade, and has gained a reputation in the international arena for the Turkish companies that undertake and carry out major contracts worldwide. The most substantial indicator of the industry's position is the fact that Turkey has been announced as the Country of Honor at JEC 2013 Paris, the most prominent international event in the industry, which was held in Paris between March 12 and 14, 2013.

The composites industry exports goods both directly and indirectly. While directly exporting the raw materials, industrial intermediate goods and finished products produced thereby through contracts awarded and projects undertaken, the industry also indirectly exports its production outputs as parts of each automobile, bus, boat, bathtub etc. exported. The industry exports its production outputs essentially to European countries, Russia, the Turkic Republics, the Middle East and North Africa. Endeavors to increase the number of export destination countries and to cover new markets are increasingly being carried out. Certain companies in the industry export their products all over the world, including the United States and even to Far Eastern countries.