The Construction Industry and Kordsa

The construction industry has transformed Istanbul and other cities, renewed and extended Turkey’s transport infrastructure and built new housing projects and other facilities all around the country. Related industries such as those pertaining to construction machinery, building materials (including cement and steel) and construction chemicals, as well as engineering and architecture services, employ tens of thousands of people. With the domestic market providing a strong base and Turkish contractors having successfully diversified their markets and projects in recent years, the construction sector is well positioned to continue growing. Given the favorable conditions in terms of population and income growth, the market should be able to maintain its expansion in the years ahead. Measured on the basis of constant exchange rates, tthe 2018 output value for the country’s construction industry amounted to US$198.7 billion.

The industry’s value is expected to rise further in 2023, thanks to investments in residential property, transport infrastructure, energy, commercial and industrial projects, as well as improvement in consumer and investor confidence. The government aims, by 2023, to transform the country into one of the top 10 global economies and to increase its manufacturing capacity and exports– for this reason, the government is developing road, airport and port infrastructure projects throughout Turkey.

During the period 2019 to 2020, the construction industry’s annual growth rate is anticipated to remain at an average of 1.6-2.0%. The industry is consequently expected to increase in value from US$198.7 billion in 2018 to US$247.3 billion in 2023, measured at constant 2017 US dollar exchange rates according to GlobalData.

Residential construction was the largest market in the industry during the review period, accounting for 58.0% of the industry’s total value in 2018. The market is anticipated to follow a similar trend, with residential construction accounting for 62.2% of the industry’s total value in 2023. The market will be supported by ongoing urbanization, population growth and positive developments in regional economic conditions. Moreover, rising demand for Turkish property among foreigners due to currency depreciation is expected to contribute to the growth of the market.

Infrastructure construction is the second-largest market, accounting for 17.7% of the industry’s total value in 2018. The market is expected to retain its position in the period 2019 to 2020 and account for 15.4% of the industry’s total value in 2023. The market output is expected to be bolstered by the government’s plan to improve the country’s transport infrastructure through public-private partnerships (PPP). Forecast-period growth will also be supported by the government’s focus on developing transport infrastructure as part of Turkey’s “Vision 2023”. By 2023, the government aims to have constructed 13,478km of new roads across the country.

Commercial construction accounted for 9.42% of the industry’s total output in 2018, followed by energy and utilities construction at 9.35%, institutional construction at 3.61% and industrial construction at 1.88%.

The total construction project pipeline in Turkey, including all mega-projects, stands at 2.3 Trillion Turkish Lira (US$ 468.2 billion). The pipeline, which includes projects at all stages of preparation from pre-planning to execution, is relatively skewed towards early-stage projects, with 53.4% of the pipeline value being in projects in the pre-planning and planning stages as of January 2019.

Turning briefly to the global construction industry, it can be predicted that the Asia-Pacific region will continue to account for the largest share of the global construction industry, including the massive markets of China, Japan and India. Growth is likely to slow, however, given the projected slowdown in China’s construction industry as well as certain weakness in South Korea. The emerging markets of South-East Asia will invest heavily in new infrastructure projects, supported by private investment. Meanwhile, construction growth in India will gather pace following a poor performance in recent years. Construction output in Australia has been volatile owing to major shifts in the oil and gas sector; however, if we exclude oil and gas from our prognosis, we can speculate that the construction industry will be boosted by solid growth in infrastructure and non-residential buildings.

Construction activity is gathering momentum across Western Europe. The region’s output will expand by 2.4% a year on average in 2018–2022. In 2016, there were sharp contractions in construction output in many Eastern European countries followed by a major reversal in 2017. Assuming EU funding continues to flow into these territories, the region will expand by 4.3% over the forecast-period. Russia’s construction investment will be focusing on road and railway projects. In addition, a recovery in the Russian oil and gas sector is expected to nurture a recovery in Russia’s construction output.

In line with its infrastructure plan, the USA is expected to increase infrastructure spending to a value of approximately US$1.5 trillion. However, much of this construction expenditure is contingent on approval from Congress. Nevertheless, the construction outlook for the USA in 2019–2020 remains solid, and the country is expected to witness ongoing investment in the construction industry.

The Middle East and Africa region as a whole will be the fastest growing region in 2018–2022, with an annual average growth of 6.0%. Countries in the Gulf Cooperation Council (GCC) have suffered from a drop in in oil prices in recent years, as government revenues have been greatly reduced. Assuming oil prices stay relatively high, large-scale investment in infrastructure projects – mostly related to transport – will be a key driving force behind growth in the region. Qatar’s construction industry will remain one of the fastest growing in the world, driven by a number of multi-billion dollar infrastructure and superstructure development projects, as well as preparations for FIFA 2022.

The pace of growth in sub-Saharan Africa will be particularly strong, averaging 6.6% a year in 2018–2022. There will be a steady acceleration in construction activity in Nigeria during the period to 2022, supported by government efforts to revitalize the economy by focusing on developing the country’s infrastructure. Ethiopia will be Africa’s best performer, with its construction industry continuing to improve in line with the country’s economic expansion.

Following recent declines in Brazil, Mexico, Colombia and Chile, construction activity in Latin America is predicted to expand in the following years, with the region growing by 1.2% in real terms. The expansion, though, will continue to be subject to downside risks in Brazil and Mexico.

Following this brief overview of the global construction industry; I am proud to confirm that Kordsa has started the production of polypropylene monofilament fibers at its plant in Izmit, Turkey.

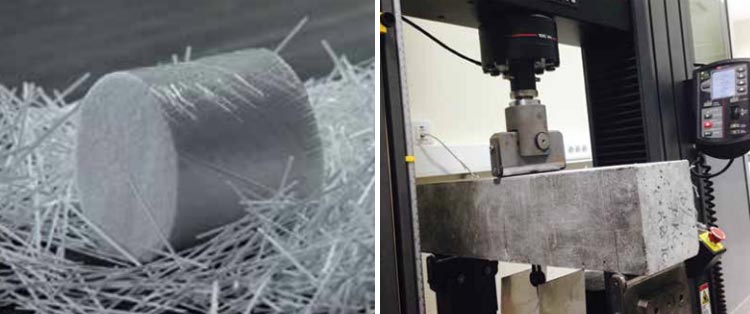

This new investment is a new version of KraTos, an innovative concrete reinforcement synthetic fiber currently being used in many prestigious projects in the construction industry.

We aim to offer our new synthetic fiber products KraTos Macro PP 40 mm and KraTos Macro PP 54 mm for use in a range of infrastructure and superstructure projects. They are expected to be chosen by sector professionals in Turkey and abroad and exploited in applications including industrial floors, concrete roads, screed, topping, slab on ground, tunnel and shotcrete linings, track slabs, port projects, hydraulic structures, precast concrete and so on. KraTos is easy and fast to use and thus saves time, and due to its homogeneous distribution properties it increases concrete toughness, offering unique structural strength as well as low carbon emissions. Providing material for truly innovative products with high engineering and performance characteristics, KraTos PP is engineered to shape the construction industry.

In 2018, we completed the segmentation of our new products and established a dedicated professional dealer network. Every member of the Construction Business Unit (CBU) possesses extensive technical expertise, enabling us to provide dedicated technical solutions that might differ from case to case. With the support of CBU’s strong and dedicated R&D team, we supply project-exclusive on-site technical support and laboratory test services, all of which set us apart from the competition. Our target for 2019 and 2020 is to expand and focus on export markets such as the USA, Europe, the Middle East, Brazil, Indonesia, Thailand and Russia. Together with the members of the Construction Business Unit and our esteemed team partners at Kordsa, we are focused on reinforcing concrete worldwide.

***Financial and Statistical Data Source: GlobalData