The Increasing Need for Life Protection Products

The global market for ballistic protection is estimated to grow at above-average rates at a CAGR of around 5.5 percent from 2017 to 2020 and is forecast to be worth $11.2 billion by 2022.

The ballistic protection market can be segmented by geography (Americas, APAC, EMEA), by type (body armor, vehicular armor), sub-type (soft armor, hard armor, personal protective headgear), and by application (defense, homeland security, commercial) and there are good opportunities in the market thanks to the high protection budgets in many developing countries. The defense segment dominates the industry with a 75 percent share of the market and it is expected to maintain its position over the coming years.

America dominated the defense market with a share of around 44 percent of it. Its military expenditure was $1.8 trillion in 2014, accounting for 34 percent of the total(1). In 2015, the US House of Representatives allocated a defense budget of $585 billion which accounts for 54 percent of the total federal discretionary spending. This resulted in a high market share, and it is expected to maintain its position due to the huge investments in this region. North America is followed by Asia-Pacific and Europe. Increasing military spending by China and India as part of their geo-political strategies is expected to further complement Asia-Pacific market growth(2). However, due to the global economic slowdown, leading spenders in the world, including the US, France, Germany, and the UK have cut spending in various defense sectors such as space, aircraft, and vehicles.

There is an increased demand of ballistic protection products like helmets, armored vehicles, and bulletproof vests: the three main categories in the ballistic segment. The soft armor segment is expected to account for 30.5 percent of the market, followed by the hard armor segment, with a share of 29.7 percent. While protective headgear and clothing account for 21.6 percent and 14.1 percent of the market respectively, the remaining 4.1 percent is accounted for by boots(3).

The increased use of soft body armor (bulletproof vests) is an accelerator for the market which is designed to improve soldier’s survivability and protect army personnel and special police task forces. It is expected to reach a value of $3.7 billion by 2023. Vehicle armor is another significant contributor within the ballistic protection market and expected to undergo a considerable growth rate over the years thanks to its excellent capability to withstand high-piercing ballistic impact. Not only these concerns, but also increasing competition between countries to demonstrate their capabilities is also expected to fuel market growth.

Investments in R&D focusing on the soldier’s comfort, the load he carries and enhanced personal protection will result in the augmented use of soft body armor.

There are two constraints hindering market growth;

1- The high cost of ballistic protection equipment

2- High equipment/protective helmet and vest weight causing immobility of the vehicle/soldier

The increased usage of improved raw materials in order to decrease ballistic protection equipment weight is expected to create new opportunities in the market. Therefore, companies are demanding lighter protective solutions, thus driving raw material companies’ product development and creating competitiveness in life protection.

Equipment weight reduction is the recent trend among market players. At the beginning, a lot of efort was put into conventional materials like steel, fiberglass (E- & S2-), and NY6.6 in manufacturing them. However, due to growing concerns and increased demands in terms of mobility and flexibility, many manufacturers have been forced to use high performance materials like ceramic, titanium, aluminum, and aramid fibers, which demonstrate outstanding strength-to-weight properties, and a high tenacity and ballistic performance.

Our aramid prepreg EF14 is an intermediate raw material used in helmets, body armor and vehicle panels production with the simultaneous application of appropriate heat and pressure so as to increase the protection level against heavier and more lethal threats like high-speed fragments as well as high-caliber rifle bullets. Aramid is fiber in which the fiber-forming substance is a long-chain synthetic polyamide in which at least 85 percent of the amide linkages are attached directly to two aromatic rings. Aramid has a more polar chemical structure when compared to UHMWPE. Therefore, it allows other substances to attach themselves to the aramid. This allows the aramid fiber to be more chemically active than UHMWPE. In addition to the polarity, its high young modulus (stinness) & low elongation at break compared to carbon or glass, resistance to strong organic solvents, good resistance to abrasion and cutting, resistance to thermal degradation, and low flammability increase the use of Kevlar fibers in life protection every passing day.

As previously mentioned, the ongoing race is to develop life protection products that stand up to complex threats and ultimately save the lives of humans while providing flexibility and comfort. It is obvious that the industry dynamics are changing. Increased protection ballistic level demand will increase the usage of lightweight materials compared to normal.

Ballistic, Stab and Spike Levels

A bulletproof vest is not designed to protect against any bullet, and body armor is available at diferent levels of protection. These standardizations have been carried out by many agencies. However, the US National Institute of Justice (NIJ) and the UK Centre for Applied Science and Technology (CAST, formerly HOSDB) are the two most important in the industry. NIJ and CAST are the world leaders in bullet and stab testing, respectively. In addition to this, any armor that meets the standard of one institution will meet the requirements of its equivalent.

Ballistic Levels

What strength of attack each level of body armor will protect against is determined by ballistic levels. The higher levels can protect against the attacks outlined for lower levels, but will still only protect up to and including the threats outlined below. Body armor incorporates bulletproof, stab-proof, and spike-proof vests, each with their own levels of protection and testing methods. The levels of protection for body armor are as follows:

Table 1 Body Armor Protection Levels(4)

| Threat |

NIJ Level IIa |

NIJ Level II |

NIJ Level IIIa |

NIJ Level III |

NIJ Level IV |

| Areal Density |

| 3.5 kg/m |

4.2 kg/m |

5.9 kg/m |

25.9 kg/m |

32.5 kg/m |

| Thickness |

| 4mm |

5mm |

6mm |

15mm |

20mm |

| .22mm short |

x |

x |

x |

x |

x |

| .9mm |

x |

x |

x |

x |

x |

| .45mm |

x |

x |

x |

x |

x |

| .380mm |

x |

x |

x |

x |

x |

| .38mm |

x |

x |

x |

x |

x |

| .22mm long |

|

x |

x |

x |

x |

| .44 Magnum |

|

|

x |

x |

x |

| .30 Carbine |

|

|

|

x |

x |

| 5.56mm |

|

|

|

x |

x |

| 7.62mm NATO |

|

|

|

x |

x |

| .30-06 |

|

|

|

x |

x |

| .30 Armour Piercing (M2 AP) |

|

|

|

|

x |

The threat levels for stab proof vests are standardised as follows:

Table 2 Stab Proof Vest Protection Level(4)

| |

KR1 |

KR2 |

| |

Knife Resistant Level 1 |

Knife Resistant Level 2 |

| Energy Level |

E1 |

E2 |

E1 |

E2 |

| Energy (joules) |

24 |

36 |

33 |

50 |

| Velocity |

5 m/sec |

6.2 m/sec |

5.9 m/sec |

7.3 m/sec |

| Total Missile Mass |

1.9 kg |

1.9 kg |

1.9 kg |

1.9 kg |

| Maximum Penetration |

7mm |

20mm |

7mm |

20mm |

CAST will only certify spike protection in addition to stab protection.

The threat levels for spike proof vests are standardised as follows:

Table 3 The threat levels for spike proof vests(4)

| |

KR1 & SP1 |

KR2 & SP2 |

| |

Knife Resistant Level 1 |

Knife Resistant Level 2 |

| Energy Level |

E1 |

E2 |

E1 |

E2 |

| Energy (joules) |

24 |

N/A |

33 |

N/A |

| Velocity |

5 m/sec |

N/A |

5.9 m/sec |

N/A |

| Total Missile Mass |

1.9 kg |

N/A |

1.9 kg |

N/A |

| Maximum Penetration |

KR1=7mm, SP1=0mm |

N/A |

KR2=7mm, SP2=0mm |

N/A |

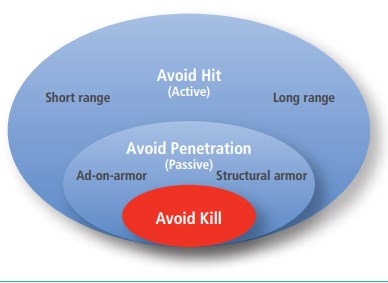

When we talk about vehicle protection, spall liners are used as add-on armor on vehicles. Here, the first aim is to avoid being hit, second aim is to avoid penetration. Spall liners made of light and advanced protection layers to help to protect a vehicle from the exposed threat.

European Committee For

Standardization Ballistic Levels |

Bullet Type |

Mass |

Velocity |

Other Standards |

| B4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| B5 |

|

|

|

|

|

|

|

|

| B6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| B7 |

- 30.06 AP (Armor Piercing)

|

|

|

|

- https://www.technavio.com/report/global-defense-ballistic-protection-market

- http://www.grandviewresearch.com/industry-analysis/ballistic-protection-market

- The Global Body Armor and Personal Protection Market 2013–2023.

- https://www.safeguardclothing.com/support/nij-levels/